Exploring the Copper Rod Price Trend: Insights, Influencing Factors, and Future Prospects

Copper Rod Price Trend, integral components in various industries, experience price fluctuations driven by diverse market dynamics. In this article, we delve into the trends shaping the Copper Rod Price Chart, key factors affecting price movements, and insights into future market outlooks.

Understanding Copper Rods

Copper rods, made from high-quality copper, serve as essential raw materials in electrical, construction, manufacturing, and automotive sectors. They are widely utilized for electrical wiring, power transmission, plumbing, and engineering applications due to their excellent electrical conductivity, thermal conductivity, corrosion resistance, and malleability.

Factors Influencing Copper Rod Prices

- Global Demand-Supply Dynamics: The demand for copper rods is influenced by various sectors such as construction, infrastructure development, electronics, and renewable energy. Fluctuations in global economic conditions, industrial activity, and infrastructure investments impact demand-supply dynamics and, consequently, copper rod prices.

- Copper Prices: Copper rod prices are closely linked to the prevailing prices of copper, the primary raw material used in their production. Factors affecting copper prices include supply disruptions, geopolitical tensions, macroeconomic indicators, currency fluctuations, and investor sentiment in commodity markets.

- Technological Advancements: Innovations in copper refining, processing, and fabrication technologies affect production efficiency, quality standards, and cost structures in the copper rod industry. Technological advancements aimed at enhancing productivity, reducing energy consumption, and minimizing environmental impacts influence overall production costs and pricing strategies.

- Regulatory Policies: Regulatory policies related to mining, environmental protection, trade tariffs, and import-export regulations impact copper mining operations, supply chains, and market dynamics. Changes in government policies, taxation regimes, and environmental standards can influence production costs, investment decisions, and market competitiveness.

- Infrastructure Development: Infrastructure projects, such as urbanization, transportation networks, power generation, and telecommunications, drive demand for copper rods in electrical wiring, construction materials, and industrial machinery. Government initiatives, stimulus packages, and public-private partnerships aimed at infrastructure development can stimulate copper rod consumption and prices.

Request for Real-Time Copper Rod Prices: https://www.procurementresource.com/resource-center/copper-rod-price-trends/pricerequest

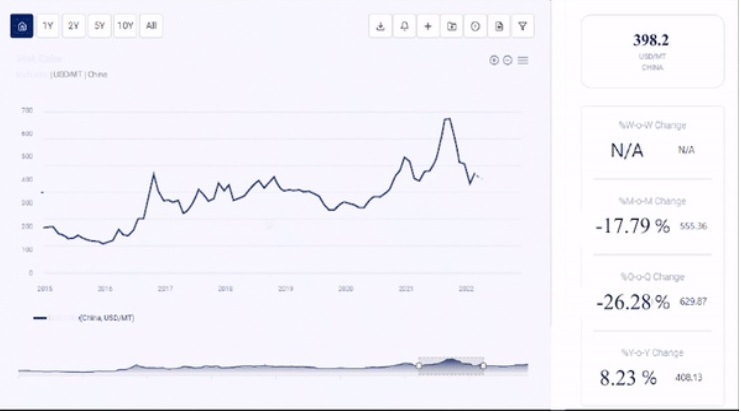

Trends in Copper Rod Prices

- Volatility in Copper Prices: Copper rod prices exhibit volatility in tandem with fluctuations in copper prices driven by supply-demand imbalances, inventory levels, geopolitical events, and macroeconomic factors. Periods of tight supply, robust demand, and speculative trading can lead to price spikes, while economic slowdowns or excess production capacity may result in price corrections.

- Infrastructure Investments: Increased infrastructure investments, particularly in emerging markets and developing economies, fuel demand for copper rods in construction, electrical grid expansion, and telecommunications networks. Mega infrastructure projects, urbanization trends, and investments in renewable energy infrastructure contribute to sustained demand for copper rods.

- Supply Chain Disruptions: Supply chain disruptions, such as labor strikes, transportation bottlenecks, natural disasters, and geopolitical conflicts, pose risks to copper rod production, distribution, and pricing. Global events impacting logistics, shipping, and trade routes can disrupt supply chains and lead to supply shortages or delivery delays, impacting prices.

- Environmental Regulations: Stringent environmental regulations governing mining operations, emissions standards, waste disposal, and water management practices influence copper production costs and operational efficiency. Compliance with environmental regulations, adoption of cleaner technologies, and investments in sustainable practices contribute to cost competitiveness and market resilience.

- Technological Innovations: Advancements in copper rod manufacturing processes, alloy formulations, surface treatments, and recycling technologies enhance product performance, quality, and cost-effectiveness. Adoption of automation, digitalization, and Industry 4.0 technologies optimizes production processes, reduces labor costs, and improves supply chain efficiency in the copper rod industry.

Future Outlook and Strategies

- Demand-Supply Balancing: Anticipating demand trends, monitoring supply conditions, and maintaining optimal inventory levels help stakeholders manage market risks, avoid stockouts, and capitalize on price fluctuations in the copper rod market.

- Risk Management: Implementing risk management strategies, such as hedging against commodity price risks, diversifying sourcing options, and building strategic partnerships with suppliers, mitigates exposure to market volatility and ensures supply chain resilience.

- Sustainable Practices: Embracing sustainable mining, production, and recycling practices aligns with environmental regulations, enhances brand reputation, and meets customer expectations for responsible sourcing and ethical business practices in the copper rod industry.

- Market Intelligence: Leveraging market intelligence tools, conducting regular market assessments, and staying informed about industry trends, competitor strategies, and regulatory developments enable informed decision-making and proactive response to market dynamics.

- Value Chain Integration: Vertical integration of value chains, from upstream mining and smelting operations to downstream fabrication and distribution networks, enhances operational efficiency, cost competitiveness, and supply chain control in the copper rod industry.

Conclusion

The copper rod market is influenced by a complex interplay of supply-demand dynamics, macroeconomic trends, technological advancements, and regulatory factors. By understanding key market drivers, monitoring price trends, and adopting strategic approaches to risk management and value creation, stakeholders can navigate market uncertainties, capitalize on emerging opportunities, and sustain long-term growth and profitability in the dynamic copper rod industry landscape.