How Does the Liquid Network Enhance Bitcoin’s Liquidity?

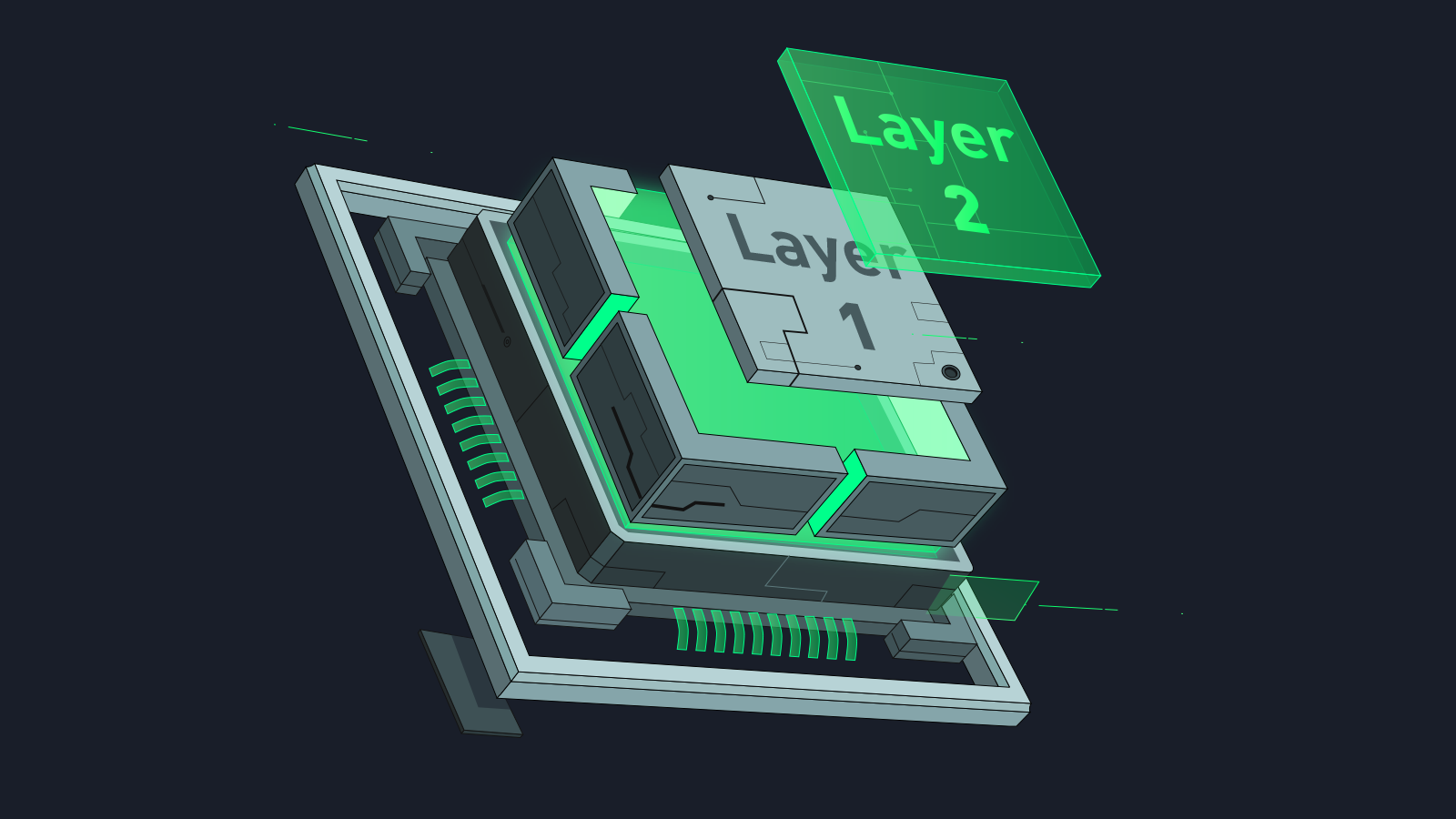

Bitcoin, the colonizing cryptocurrency, has transformed the commercial landscape since its beginning in 2009. With its decentralized kind and pioneering blockchain technology, Bitcoin offers numerous benefits over usual order currencies. One important facet of some economic advantage, including Bitcoin, is liquidity. In this portion, we will investigate the idea of liquidity as it applies to Bitcoin Layer 2 Development, its significance for extensive adoption, and the challenges it faces.

Defining Liquidity in the Context of Bitcoin

Liquidity Defined: Liquidity refers to the ease with which an asset maybe purchased or sold out concerning business without considerably moving its price. In clearer terms, it measures how fast an asset can be transformed into cash without making a solid change in its profit. For Bitcoin, liquidity decides its utility as a currency, store very important, and expenditure advantage.

Bitcoin’s Unique Characteristics: Unlike established fiat currencies, Bitcoin operates in a decentralized approach, free from government control and guidance. Its restricted supply eclipsed at 21 million coins and assumed transactions increase its appeal. However, these rare characteristics influence its liquidity dynamics, affecting determinants like trading volume, merchandise insight, and price stability.

Importance of Liquidity for Bitcoin Adoption

Market Efficiency: High liquidity supports display effectiveness by lowering transaction costs and underrating price slippage. Traders and financiers can enter and exit positions rapidly, reinforcing overall display exercise and price finding.

Price Stability: Liquidity is essential for upholding price security, exceptionally in times of market airiness. A liquid market absorbs big buy or sell orders without leading to significant price variations, so introducing assurance with display shareholders.

Accessibility: Adequate liquidity makes Bitcoin more approachable to a fuller range of consumers, containing sell financiers, organizations, and businesses. It furthers logical transactions, reinforces liquidity pools, and boosts better endorsement and agreement of Bitcoin as a legitimate asset class.

Challenges in Bitcoin Liquidity

Volatility: Bitcoin’s price volatility, from fast and unreliable price swings, poses an important challenge to liquidity. While excitability attracts theoretical dealers, it can prevent sellers and users from utilizing Bitcoin for usual transactions.

Regulatory Hurdles: Regulatory changeableness and irregular tactics across jurisdictions can impact Bitcoin liquidity. Ambiguous requirements may dissuade uniform financiers and traditional monetary organizations from engaging in Bitcoin markets, confining liquidity and prevailing endorsement.

Scalability Issues: Bitcoin’s scalability restraints, manifested in network blockage and extreme transaction expenses all the while peak periods, can obstruct liquidity and utility. Scalability solutions to a degree the Lightning Network aims to address these challenges, but extensive exercise remnants introduce progress.

What is the Liquid Network?

The Liquid Network, started in 2018 by Blockstream, serves as an allied sidechain built in addition to the Bitcoin blockchain. It authorizes faster, secret, and secure Bitcoin transactions between competing exchanges, organizations, and stockbrokers. Unlike the Bitcoin mainnet, which prioritizes decomposition and forbiddance fighting, the Liquid Network focuses on improving liquidity and variable effectiveness. The beginning of the Liquid Network stems from the need for a reliable and adaptable resolution to address Bitcoin’s liquidity challenges. Blockstream, a superior wage earner of blockchain sciences, led the incident efforts, leveraging allure knowledge in cryptographic change and blockchain foundation.

How Does the Liquid Network Operate?

Sidechain Technology Explained: A sidechain is an additional blockchain that works alongside the main blockchain (in this case, Bitcoin). The Liquid sidechain allows faster transaction confirmations and supports supplementary features in the way that secret transactions and asset issuance.

Federated Model and Security Measures: The Liquid Network employs a allied consensus model, wherein a predefined set of functionaries (known as functionaries) together substantiate transactions and maintain network honor. This allied approach reinforces safety and scalability while maintaining network efficiency.

Confidential Transactions: One of the rare features of the Liquid Network is its support for secret transactions, that confuse transaction amounts while continuing variable integrity. This privacy–enhancing feature appeals to merchants, organizations, and things pursuing better confidentiality in their transactions

Benefits of the Liquid Network

The Liquid Network offers a large group of benefits for Bitcoin consumers, ranging from reinforced liquidity and faster transaction settlements to improved privacy and interoperability accompanying the existent monetary foundation. In this portion, we will investigate the benefits of leveraging the Liquid Network for Bitcoin transactions and asset administration.

Enhanced Liquidity for Bitcoin: The Liquid Network considerably embellishes Bitcoin liquidity by enabling fast and private transactions between network members. Traders and organizations can influence the Liquid sidechain to kill difficult situations outside impacting the more extensive market, through reconstructing liquidity and price support.

Faster Transactions and Settlement Times: Compared to the Bitcoin mainnet, which depends block confirmations for transaction conclusiveness, the Liquid Network offers faster transaction settlements through its allied consensus method. This allows near–immediate transfers of Bitcoin and added digital assets, lowering transactional friction and enhancing user experience.

Confidentiality and Privacy Features: Privacy is superior in the world of finance, and the Liquid Network discharges on this front accompanying its support for confidential transactions. By disguising transaction amounts and continuing consumer privacy, the Liquid Network offers a level of secrecy namely crucial for bland financiers, high–net–worth things, and privacy–conscious users.

Interoperability accompanying Exchanges and Wallets: The Liquid Network seamlessly integrates accompanying existent cryptocurrency exchanges, wallets, and business platforms, allowing consumers to access allure liquidity and solitude features without difficulty. This interoperability improves the utility of Bitcoin and adds digital property inside the Liquid environment, supporting a alive and effective forum.

Use Cases and Applications

The flexibility of the Liquid Network extends further absolute variable effectiveness, revealing a myriad of beneficial cases and requests across various subdivisions of frugality. In this portion, we will survey a few of the efficient uses of the Liquid Network and its potential to transform traditional finance and digital asset administration.

Facilitating Faster Arbitrage Trading: Arbitrage trading, the practice of misusing price characteristics between various markets, depends on fast and effective transaction settlements. The Liquid Network supplies sellers with a trustworthy podium for killing trading of stock by computer designs, on account of its near–immediate transaction confirmations and embellished liquidity.

Streamlining Cross-Border Payments: Cross–border payments are prominent for their incompetence and extreme costs, often annoyed by extended transform occasions and extravagant commissions. The Liquid Network offers an irresistible solution to this problem by permissive abrupt and economical transfers of Bitcoin and other digital assets across borders, avoiding traditional banking mediators.

Enabling Secure Token Issuance: Tokenization, the process of describing real–world assets as digital tokens on a blockchain, has gained friction in recent ages due to its potential to democratize the approach to financing opportunities. The Liquid Network simplifies the distribution of protection tokens, digital likenesses of impartiality, deficit, and other economic mechanisms, securely and obediently.

Supporting OTC Trading Desks: Over-the-counter (OTC) trading desks play an important function in facilitating big–capacity trades of Bitcoin and different digital assets outside of usual exchanges. The Liquid Network provides OTC desks accompanying a trustworthy floor for killing trades accompanying reinforced solitude, liquidity, and protection, catering to the needs of bland financiers and high–net–worth individuals.

Comparison with Other Solutions

In the vying landscape of blockchain-based liquidity solutions, the Liquid Network is conspicuous for its unique features and capacities. In this section, we will analyze the Liquid Network with different important solutions, containing the Lightning Network and Wrapped Bitcoin (WBTC), in addition to usual banking settlement methods.

Liquid Network vs. Lightning Network

The Lightning Network, another Bitcoin Layer 2 Blockchain Solutions, shares few correspondences accompanying the Liquid Network but differs in its approach and goals. While both networks aim to improve Bitcoin’s scalability and transaction throughput, the Lightning Network focuses on sanctioning micropayments and instant transactions, whereas the Liquid Network prioritizes liquidity and privacy for larger–value transfers.

Liquid Network vs. Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) is an Ethereum-based token that shows Bitcoin on the Ethereum blockchain. Unlike the Liquid Network, which operates as additional sidechain insured by an allied consensus model, WBTC depends on custodians to hold and survive the fundamental Bitcoin reserves. While WBTC offers interoperability accompanying the Ethereum ecosystem, it lacks the solitude and protection guarantees supported for one Liquid Network.

Liquid Network vs. Traditional Banking Settlement Systems

Compared to established banking settlement systems, in the way that SWIFT (Society for Worldwide Interbank Financial Telecommunication) and ACH (Automated Clearing House), the Liquid Network offers various benefits, along with faster transaction settlements, lower bills, and enhanced solitude. By leveraging blockchain science and cryptographic novelty, the Liquid Network supplies a more effective and secure alternative to legacy banking infrastructure.

How to Access and Utilize the Liquid Network

Accessing and appropriating the Liquid Network is honest, thanks to its user-friendly interface and smooth integration with current cryptocurrency wallets and exchanges. In this portion, we will outline the steps for starting a Liquid wallet, engaging in Liquid sidechain transactions, and merging the Liquid Network with exchanges and platforms.

Setting Up a Liquid Wallet

To access the Liquid Network, users need to download and install an agreeable Liquid wallet, to a degree Blockstream Green or the Liquid Core Wallet. Once installed, consumers can create a new wallet, create a hint seed phrase for wallet recovery, and start sending and receiving Liquid assets.

Participating in Liquid Sidechain Transactions

To take part in Liquid sidechain transactions, consumers can deposit Bitcoin into their Liquid wallet and convert it into Liquid Bitcoin (L-BTC), the native asset of the Liquid Network. Once transformed, users can transfer L-BTC to different Liquid addresses or use it for business, loans, or fees inside the Liquid environment.

Integrating Liquid Network with Exchanges and Platforms

Cryptocurrency exchanges and trading platforms play an important part in the liquidity and approachability of the Liquid Network. Users can deposit and retract assets to and from engaging in exchanges, trade L-BTC, and other Liquid assets, and influence the liquidity pools determined by exchange partners.

Challenges and Future Outlook

Despite its hopeful trajectory, the Liquid Network faces various challenges on its allure path to extensive ratification. Regulatory inquiry, interoperability issues, and contest from alternative answers pose potential hurdles to allure progress. However, with continuous exertions, crucial alliances, and societal support, the Liquid Network is well–stuck to overcome these challenges and emerge as a chief liquidity resolution for Bitcoin and digital assets.

Final Thoughts

In conclusion, the Liquid Network considerably reinforces Bitcoin’s liquidity by providing a secure and adept platform for the issuance, transfer, and business of digital property. By enabling faster conclusion opportunities and secret transactions, Liquid offers consumers the flexibility to move their Bitcoin and additional assets seamlessly across aiding exchanges and organizations. This raised liquidity not only benefits traders and financiers by lowering counterparty risk and bettering market effectiveness