The Revolution of AI Crypto Traders: Exploring the Future of Automated Trading

The fusion of artificial intelligence (AI) and cryptocurrency trading has given rise to a new era of automated trading known as AI crypto traders. These sophisticated algorithms leverage AI techniques to analyze market data, identify patterns, and execute trades autonomously in the volatile and rapidly evolving cryptocurrency markets. In this article, we delve into the intricacies of AI crypto traders, exploring their features, benefits, challenges, and the transformative impact they have on the landscape of crypto trading.

Understanding AI Crypto Traders

AI crypto traders are computer programs that use AI and machine learning algorithms to analyze vast amounts of data from cryptocurrency markets. These algorithms learn from historical data and market patterns to make predictions about future price movements and execute trades accordingly. AI crypto traders can operate across various cryptocurrency exchanges, including platforms like Binance, Coinbase, and Bitfinex.

Features and Functionality

AI crypto traders offer a range of features and functionalities designed to optimize trading strategies and maximize profitability:

- Advanced Analytics: AI crypto traders employ advanced analytical techniques, including machine learning algorithms and natural language processing, to analyze market data, news sentiment, and social media trends. This analysis enables traders to make informed decisions and capitalize on market opportunities.

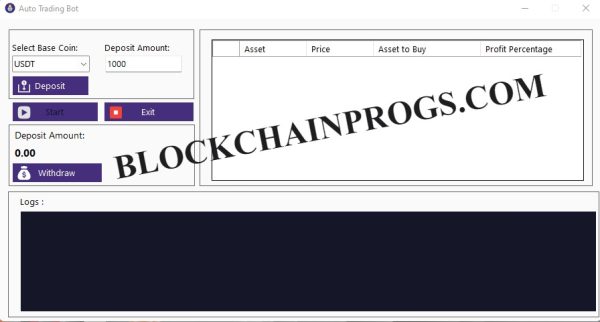

- Automated Trading: One of the primary features of AI crypto traders is automation. These algorithms can execute trades autonomously based on predefined criteria, such as price thresholds, technical indicators, and risk parameters. This automation eliminates the need for manual intervention and enables traders to capitalize on opportunities 24/7.

- Risk Management: AI crypto traders incorporate risk management techniques to protect capital and minimize losses. These algorithms can implement stop-loss orders, position sizing strategies, and portfolio diversification to manage risk exposure effectively.

- Scalability: AI crypto traders are highly scalable, capable of processing large volumes of data and executing trades across multiple cryptocurrency markets simultaneously. This scalability enables traders to capitalize on opportunities across diverse assets and exchanges.

- Adaptability: AI crypto traders are adaptive and can adjust their trading strategies in real-time based on changing market conditions. These algorithms can quickly respond to new information, market trends, and volatility, ensuring optimal performance in dynamic trading environments.

Benefits of AI Crypto Traders

AI crypto traders offer several benefits to traders and investors:

- Enhanced Efficiency: AI crypto traders operate with speed and efficiency, executing trades within milliseconds and capitalizing on market opportunities in real-time. This efficiency enables traders to stay ahead of the competition and maximize profits.

- Emotion-Free Trading: AI crypto traders remove human emotions from the trading process, eliminating fear, greed, and other psychological biases that can cloud judgment and lead to irrational decisions. This emotion-free trading approach helps traders stick to their predefined strategies and maintain discipline in volatile markets.

- Improved Decision-Making: AI crypto traders leverage advanced analytics and predictive modeling techniques to make data-driven decisions. These algorithms can analyze complex market data and identify patterns that may not be apparent to human traders, resulting in more accurate predictions and better trading outcomes.

- Continuous Learning: AI crypto traders are constantly learning and adapting to new market conditions, incorporating new data and insights to refine their trading strategies over time. This continuous learning process enables traders to stay agile and responsive to changes in the cryptocurrency markets.

- Accessibility: AI crypto traders democratize access to sophisticated trading strategies and analytics, making them accessible to both retail and institutional investors. These algorithms level the playing field, allowing traders of all experience levels to compete in the cryptocurrency markets.

Challenges and Considerations

Despite their numerous benefits, AI crypto traders also pose certain challenges and considerations:

- Technical Complexity: AI crypto traders can be complex to develop, implement, and maintain, requiring specialized knowledge of AI techniques, programming languages, and cryptocurrency markets.

- Data Quality and Bias: The effectiveness of AI crypto traders depends on the quality and diversity of the data they analyze. Biases in the data, such as sample selection bias or data snooping bias, can lead to inaccurate predictions and suboptimal trading outcomes.

- Market Volatility: The cryptocurrency markets are notoriously volatile, with prices often experiencing rapid fluctuations. AI crypto traders may struggle to perform effectively in highly volatile market conditions, leading to unexpected losses or underperformance.

- Regulatory Compliance: Traders using AI crypto traders must ensure compliance with relevant regulations and legal requirements, especially when trading in regulated markets or using advanced trading strategies such as algorithmic trading.

- Security Concerns: AI crypto traders require access to sensitive information, such as exchange APIs and private keys, raising security concerns. Traders must implement robust security measures to protect their assets and personal information from unauthorized access or theft.

Future Trends and Innovations

Looking ahead, the future of AI crypto traders promises continued innovation and evolution:

- Integration of Blockchain Technology: The integration of blockchain technology into AI crypto traders could enhance transparency, security, and efficiency, revolutionizing the way financial transactions are conducted and settled.

- Quantum Computing: Advances in quantum computing could enable the development of more powerful AI algorithms capable of processing vast amounts of data and executing complex trading strategies with unprecedented speed and accuracy.

- Regulatory Evolution: Regulatory frameworks governing AI crypto traders are likely to evolve in response to technological advancements and changing market dynamics, with regulators seeking to strike a balance between innovation and investor protection.

- Interoperability and Collaboration: AI crypto traders may collaborate and share insights with other AI algorithms, creating synergies and enhancing trading performance through collective intelligence and collaboration.

- Decentralized Autonomous Traders: The emergence of decentralized autonomous traders (DATs) could decentralize trading operations, enabling AI algorithms to trade autonomously without human intervention on decentralized exchanges (DEXs) and blockchain networks.

Conclusion

AI crypto traders represent a paradigm shift in the world of cryptocurrency trading, offering advanced analytics, automation, and predictive capabilities to traders and investors. While these algorithms present numerous benefits, they also pose challenges and considerations, including technical complexity, data quality, and regulatory compliance. Looking ahead, the future of AI crypto traders promises continued innovation and evolution, driven by advances in technology, changing market dynamics, and evolving regulatory frameworks. By harnessing the capabilities of AI crypto traders effectively, traders and investors can optimize their trading strategies, minimize risks, and capitalize on opportunities in the dynamic and rapidly evolving world of cryptocurrency markets.